COINBOY Competition Results: A Deep Dive into a $9.7M Trading Battle

Table of Contents

- Introduction

- Competition Overview

- Overall Performance Analysis

- Top Performers: A Tale of Two Metrics

- Trading Style and Volume Insights

- Performance Distribution and Key Takeaways

- Conclusion

Introduction

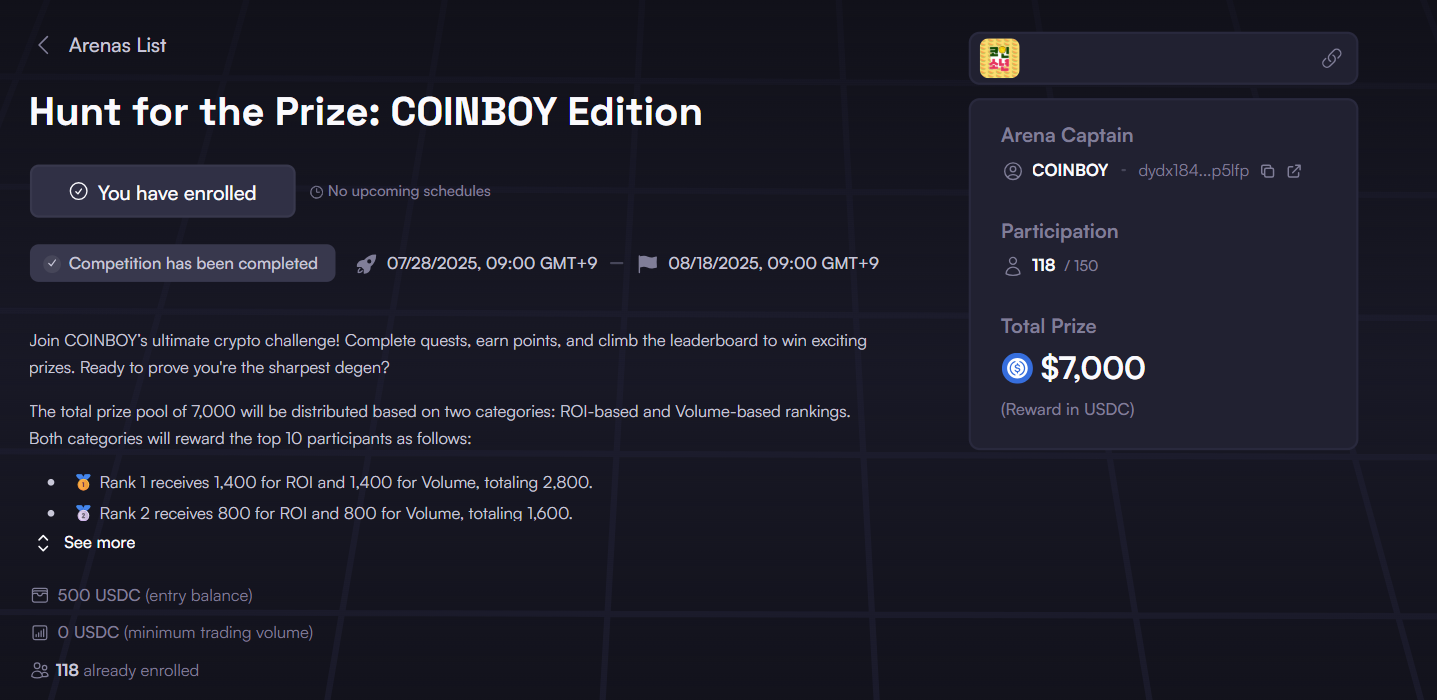

The dYdX Trading Arena recently hosted the "Hunt for the Prize: COINBOY Edition," an exciting competition that challenged traders to prove their skills. With a unique prize structure rewarding both profitability (ROI) and activity (Volume), the event attracted a diverse range of participants and generated significant trading volume.

This article provides a comprehensive analysis of the competition's results, uncovering key trends, top trader strategies, and the valuable lessons learned from a high-stakes, challenging market environment.

Competition Overview

The competition featured a dual-reward system designed to recognize both strategic profitability and significant market participation.

- Platform: dYdX Trading Arena

- Active Participants: 118

- Total Trading Volume: Approx. 9.7 Million USDC

- Total Fees Generated: Approx. 4,111 USDC

- Prize Pool: $7,000, split equally between the top 10 by ROI and the top 10 by Volume.

Overall Performance Analysis

The competition data reveals an extremely challenging trading environment where cumulative losses significantly surpassed gains.

| Metric | Value |

|---|---|

| Overall Net PnL of Participants | -$144,800 |

| Total Profit from Winners | $7,244.2 |

| Total Loss from Losers | -$150,200 |

The staggering negative net PnL indicates that the period was brutal for the majority of traders, highlighting the high-risk nature of leveraged trading and the difficulty of achieving consistent profitability.

Top Performers: A Tale of Two Metrics

The competition's dual prize structure created a fascinating divergence, with the leaderboards for ROI and Volume being dominated by entirely different sets of traders.

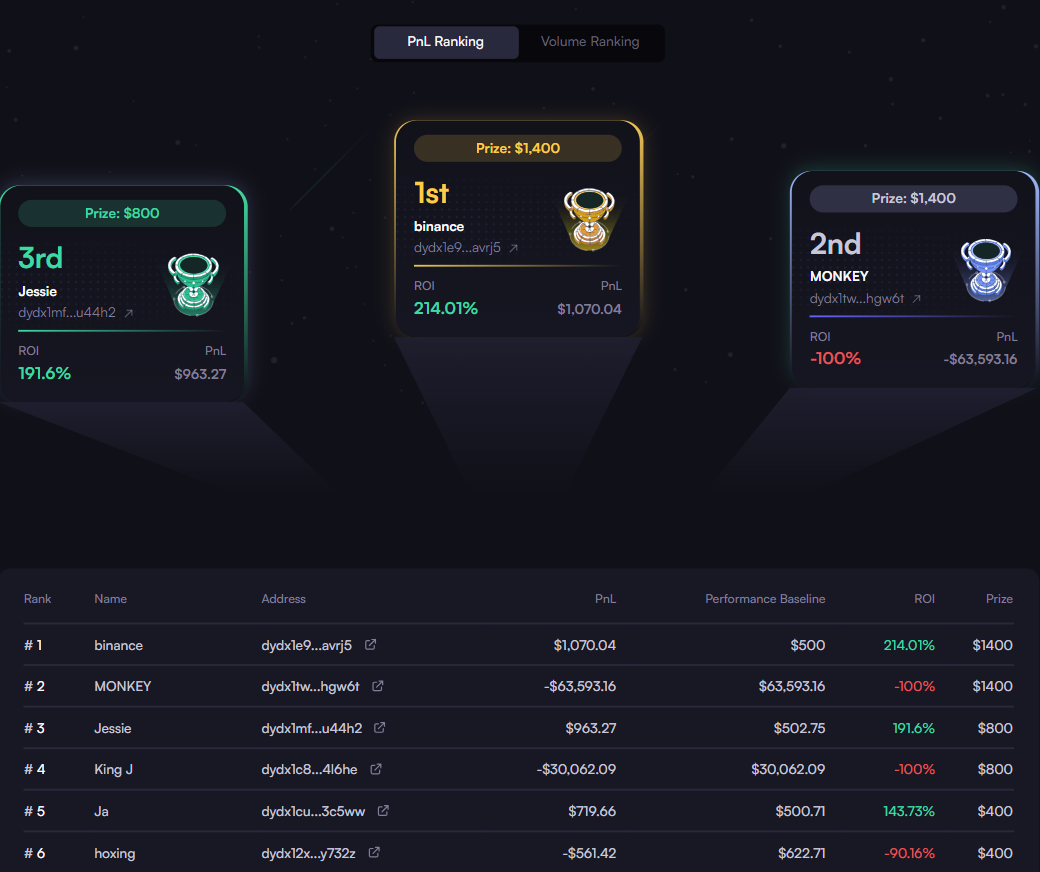

Top 3 by ROI (Profitability)

These traders demonstrated exceptional skill, navigating the volatile market to achieve outstanding returns.

- binance

- ROI: 214.01%

- PnL: +$1,070.04

- Jessie

- ROI: 191.60%

- PnL: +$963.27

- Ja

- ROI: 143.73%

- PnL: +$719.66

Top 3 by Trading Volume (Activity)

These participants drove the vast majority of the competition's activity, generating millions in volume.

- MONKEY: 4,169,180 USDC

- King J: 1,193,380 USDC

- hoxing: 547,373 USDC

A critical insight from the competition is the complete lack of overlap between these two groups. The top volume traders (MONKEY, King J, and hoxing) all finished with significant negative ROIs, with the top two losing their entire capital and more. Conversely, the top ROI performer, binance, generated less than $10,000 in volume. This starkly illustrates the difference between a high-frequency, activity-focused strategy and a more cautious, profit-oriented approach.

Trading Style and Volume Insights

The competition was overwhelmingly dominated by aggressive, execution-focused trading.

- Maker Volume (providing liquidity): Approx. 10.6%

- Taker Volume (taking liquidity): Approx. 89.4%

Trading activity was highly concentrated. The top two volume generators, MONKEY and King J, were responsible for over 58% of the entire competition's $9.7M volume, showcasing how a few power traders can drive market dynamics.

Performance Distribution and Key Takeaways

The performance breakdown paints a clear picture of the competition's difficulty and the polarized outcomes.

- Participants with Positive ROI: 15 (approx. 12.7%)

- Participants with Negative ROI: 47 (approx. 39.8%)

- Inactive Participants: 56 (approx. 47.5%)

Key takeaways from this distribution include:

- High Inactivity: Nearly half of the participants did not place a single trade, pointing to a potential barrier to entry or a cautious stance in a volatile market.

- Profitability was Rare: Only a small fraction of traders (12.7%) managed to end the competition with a profit.

- Substantial Risk: The large number of traders with a -100% ROI underscores the immense risks involved. Many participants lost their entire starting capital, a harsh lesson in risk management.

Conclusion

The "Hunt for the Prize: COINBOY Edition" was a competition of extremes. It generated an impressive $9.7 million in trading volume, yet the overall participant pool ended with a significant net loss, highlighting a brutal market.

The unique dual-prize structure successfully revealed the profound difference between trading for volume and trading for profit. The results showed that these two objectives required vastly different strategies, with the most active traders suffering the largest losses and the most profitable traders adopting more conservative, liquidity-providing tactics.

This event serves as another testament to the dYdX Trading Arena's capacity to host dynamic, community-driven events that provide valuable insights for traders of all levels. To participate in future competitions, visit the official website at https://dydxarena.com/.