DEG Server Smart Trader v2 Results: Analyzing Trader Strategies from a 3-Week Battle

Table of Contents

- Introduction

- Competition Overview

- Overall Performance Analysis

- Top Performer Analysis

- Insights into Trading Volume and Styles

- Performance Distribution and Market Lessons

- Conclusion

Introduction

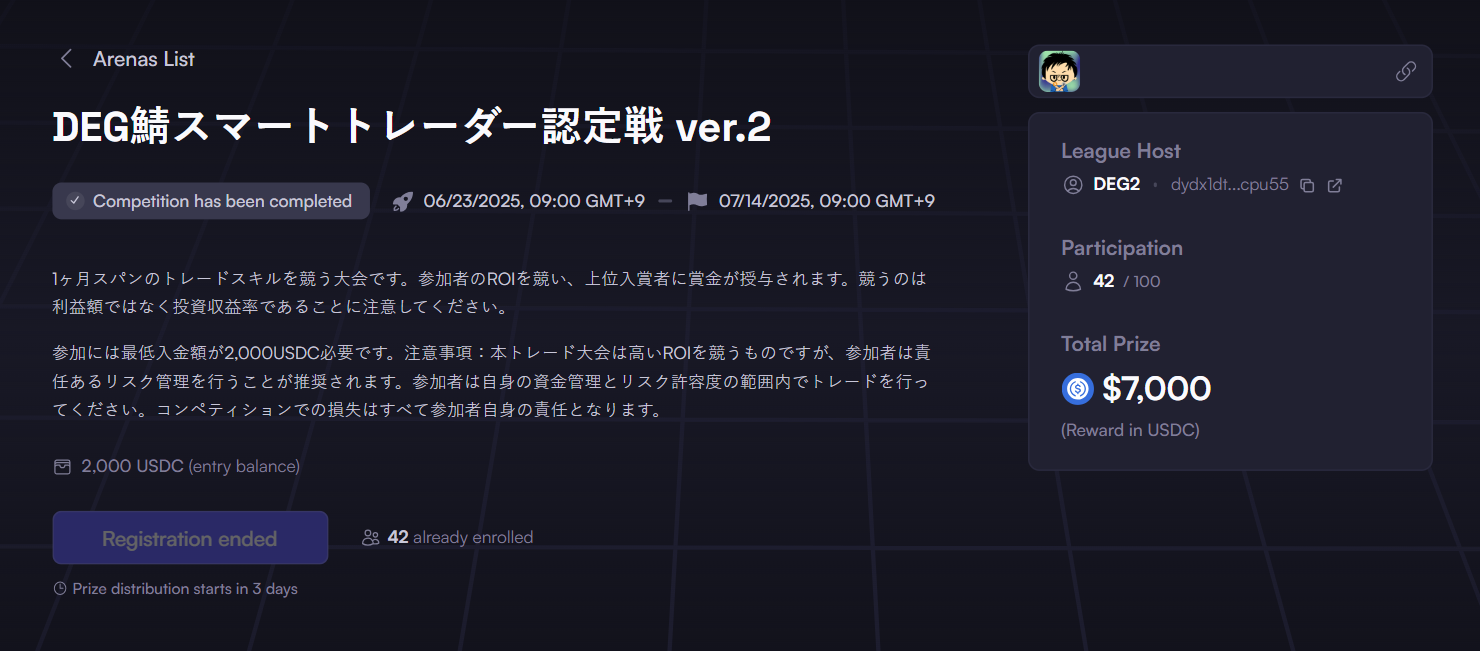

Launched in April 2025, the dYdX Trading Arena has hosted a variety of trading competition formats. Following the short-term, intensive "Pachinko King" series, the platform recently held the "DEG Server Smart Trader Certification Battle Ver.2," a three-week competition designed to test traders' strategies and endurance.

This article provides a detailed analysis of the competition, which ran from June 23 to July 14, 2025, sharing insights gained from top trader performances and overall trading trends.

Competition Overview

The "DEG Server Smart Trader v2" was a medium-term strategy competition focused on ROI (Return on Investment), held in collaboration with DEG, who runs Japan's largest crypto trader community.

- Duration: June 23 - July 14, 2025 (3 weeks)

- Platform: dYdX Trading Arena

- Registered Participants: 48

- Active Participants: 42

- Total Trading Volume: Approx. 7,458,000 USDC

- Total Fees Generated: Approx. 2,500 USDC

Overall Performance Analysis

The data suggests that the market conditions during the competition were challenging for participants.

| Metric | Value |

|---|---|

| Overall Net PnL of Participants | -$12,304.89 |

| Total Profit from Winners | $21,491.93 |

| Total Loss from Losers | -$33,796.82 |

The negative overall net PnL indicates the difficulty of zero-sum trading and likely points to high market volatility during the period.

Top Performer Analysis

Despite the challenging market, some traders achieved outstanding returns through exceptional skill. Here are the top 3 performers by ROI:

- aruwaioh99

- ROI: 168%

- PnL: +$3,368.54

- ponnn

- ROI: 148%

- PnL: +$3,005.75

- irukiti1

- ROI: 145%

- PnL: +$2,902.47

A noteworthy point is that the third-place finisher, irukiti1, conducted 100% of their trades using maker orders (limit orders). This proves that a strategy focused on earning fees while steadily accumulating profits can be highly effective in a medium-term competition.

Insights into Trading Volume and Styles

The competition generated a massive trading volume of over 7.45 million USDC.

Top 5 by Trading Volume

- ponnn: 2,349,220 USDC

- ssugaya_2: 969,415 USDC

- yamadori_2: 566,747 USDC

- a_o_: 463,393 USDC

- qwerare: 387,010 USDC

An interesting relationship emerged between trading volume and final performance.

- Success Story: The top volume trader, ponnn, also secured second place in ROI, demonstrating how aggressive trading can lead to high returns. Over 95% of their trades were taker orders (market orders), indicating a successful aggressive strategy.

- No Correlation: In contrast, the second-highest volume trader, ssugaya_2, ended with an ROI of -100%, losing their entire capital. This highlights that high trading volume does not always guarantee profit.

The overall ratio of maker to taker orders was approximately 20% to 80%, respectively. Similar to short-term competitions, this suggests that many participants favored the immediate execution of taker orders.

Performance Distribution and Market Lessons

The performance distribution of the 42 active participants reveals the realities of trading.

- Achieved Positive ROI: 15 participants (approx. 35.7%)

- Negative ROI: 23 participants (approx. 54.8%)

- ROI of -1.0 (Total Capital Loss): 12 participants (approx. 28.6%)

The fact that nearly 30% of active participants lost their entire capital underscores the high risks associated with leveraged trading. The three-week duration was too short to recover from a single large loss, yet long enough for small losses to accumulate, highlighting the critical importance of strict risk management.

Conclusion

The "DEG Server Smart Trader v2" once again proved that the dYdX Trading Arena is a flexible platform capable of hosting competitions of various durations. The total trading volume of over $7.45 million demonstrates the potential of community-driven events to bring significant liquidity to the dYdX ecosystem.

This competition showed that success in a medium-term timeframe depends on strategy, risk management, and mental fortitude. The diverse success stories, from a pure-maker strategist to a high-volume, high-return trader, provided valuable lessons for all participants.

The dYdX Trading Arena will continue to host exciting trading events in collaboration with community leaders worldwide. For more details, please visit the official website at https://dydxarena.com/.