Onchain Royale Results: A Deep Dive into a $7.1M Taker-Only Trading Battle

Table of Contents

- Introduction

- Competition Overview

- Overall Performance Analysis

- Top Performer Analysis

- Trading Volume and Style Analysis

- Performance Distribution and Key Takeaways

- Conclusion

Introduction

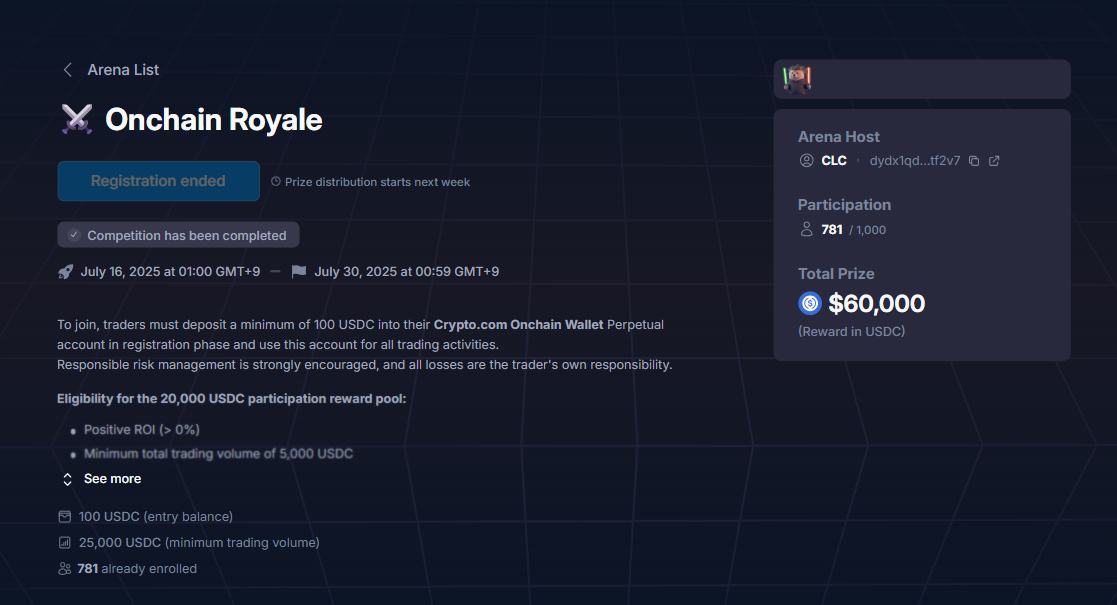

In a major collaboration, dYdX and Crypto.com hosted the Onchain Royale trading competition from July 15 to July 28, 2025. With a massive 60,000 USDC prize pool, the event attracted significant attention, drawing 781 registrants to compete on the dYdX Trading Arena platform.

This article provides a detailed analysis of the competition's results, exploring the financial outcomes, top trader performances, and unique insights derived from an environment where only Taker orders were possible.

Competition Overview

The Onchain Royale was one of the largest competitions hosted on the platform to date, though the trading activity was concentrated among a small fraction of participants.

- Duration: July 15 - July 28, 2025 (2 weeks)

- Platform: dYdX Trading Arena (via Crypto.com Onchain Wallet)

- Total Registered Participants: 781

- Active Participants: 83 (10.6% activation rate)

- Total Trading Volume: Approx. 7,100,000 USDC

- Total Fees Paid (Taker Fees): Approx. 3,351 USDC

The low conversion rate from registration to active trading is a key takeaway, highlighting an area for improvement in future large-scale events.

Overall Performance Analysis

The two-week competition period proved to be exceptionally challenging for traders, resulting in a significant overall net loss.

| Metric | Value |

|---|---|

| Overall Net PnL of Participants | -$21,350.14 |

| Total Profit from Winners | $4,774.67 |

| Total Loss from Losers | -$26,124.81 |

The data reveals that total losses were more than five times the total profits, underscoring a highly volatile and difficult trading environment where most participants struggled to stay profitable.

Top Performer Analysis

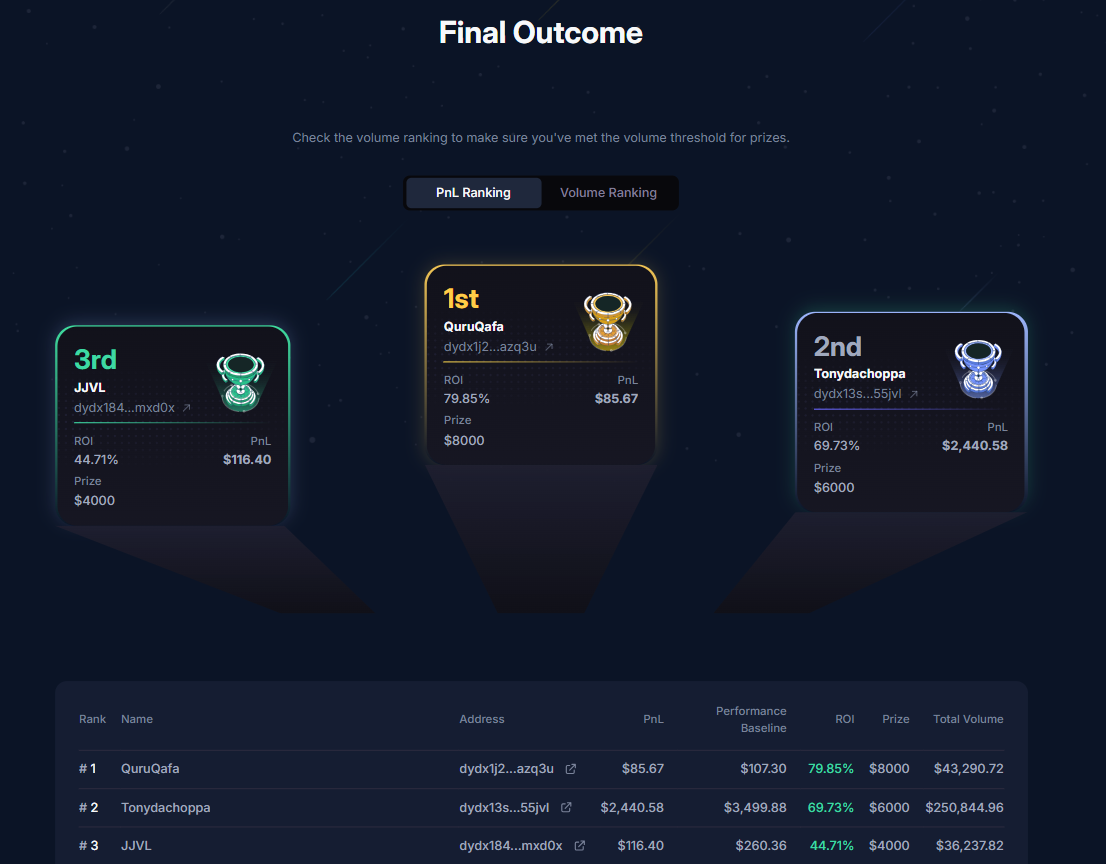

The competition's rules for the 40,000 USDC Champions Pool required traders not only to achieve a high ROI but also to meet a minimum trading volume of $25,000 and execute at least three trades. This dual requirement led to a significant reshuffling of the final leaderboard compared to one based on raw ROI alone.

It was unfortunate that several traders who achieved very high ROI percentages were ultimately disqualified from the Champions Pool because they did not meet the minimum trading volume requirement. This highlights the importance of understanding all competition rules.

The final, official leaderboard rewarded traders who successfully balanced profitability with significant trading activity. Here are the top 3 performers:

| Rank | Name | Prize (USDC) | ROI | PnL (USDC) | Trading Volume (USDC) |

|---|---|---|---|---|---|

| 1 | QuruQafa | $8,000 | 79.85% | $85.67 | $43,290 |

| 2 | Tonydachoppa | $6,000 | 69.73% | $2,440.58 | $250,845 |

| 3 | JJVL | $4,000 | 44.71% | $116.40 | $36,238 |

A notable insight is that the second-place finisher by ROI, Tonydachoppa, generated the largest absolute profit by a wide margin. This demonstrates the difference between high-percentage gains on smaller capital and substantial PnL from larger-scale trading.

Trading Volume and Style Analysis

This competition had a unique characteristic: all trading was conducted through the Crypto.com Onchain Wallet, which exclusively supports Taker orders.

The Taker-Only Environment This technical constraint meant that 100% of the $7.1M volume consisted of Taker trades. Participants could not use Maker (limit) orders to provide liquidity and earn fees. This unified the trading style across the board, forcing all active participants to adopt aggressive, execution-focused strategies.

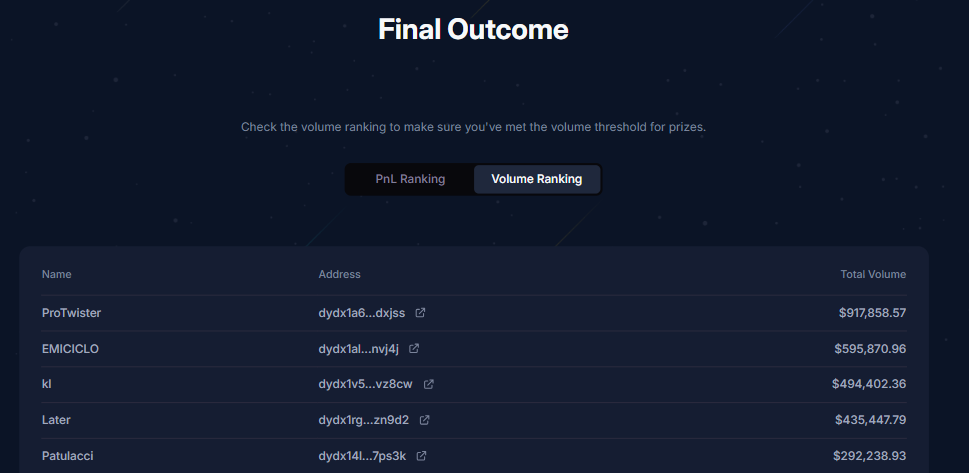

Top 5 by Trading Volume

Trading volume was heavily concentrated among a handful of elite traders, with the top five accounting for over $2.7 million (approx. 38%) of the total volume.

- ProTwister: 917,858 USDC

- EMICICLO: 595,870 USDC

- kl: 494,402 USDC

- Later: 435,447 USDC

- Patulacci: 292,238 USDC

This concentration highlights that a small group of power users drove the vast majority of the activity on the dYdX protocol during the event.

Performance Distribution and Key Takeaways

The performance breakdown of the 83 active traders paints a stark picture of the competition's difficulty.

- Achieved Positive ROI: 20 participants (approx. 24.1%)

- Negative ROI: 63 participants (approx. 75.9%)

The results were highly polarized, with a small minority of traders finding success while three-quarters of the participants ended with a loss. This high-risk environment underscores the challenges of the Taker-only format combined with difficult market conditions.

A surprising outcome was that the 20,000 USDC Participation Pool had zero eligible winners. The eligibility rules required both a positive ROI and a minimum trading volume of $5,000. Due to the tough market, very few traders maintained a positive PnL, and those who did failed to meet the volume threshold. This left the entire pool unclaimed and highlighted how strict eligibility criteria can be in volatile conditions.

Furthermore, the strict eligibility rules for the Champions Pool emphasized the importance of not just profitability, but also active participation, as several high-ROI traders were disqualified for failing to meet the volume threshold.

Conclusion

The dYdX x Crypto.com Onchain Royale was a monumental event that generated over $7.1 million in trading volume, demonstrating the immense potential of large-scale collaborations to drive engagement. However, the results also provided critical lessons.

The competition was defined by several key factors: a challenging market that led to a net loss for the participant pool, a unique Taker-only trading environment that shaped all strategies, strict eligibility rules that reshaped the final rankings, and a low activation rate that points to opportunities for improving user onboarding in future events.

Despite the tough conditions for many, the Onchain Royale successfully brought significant activity to the dYdX ecosystem and offered a valuable, high-stakes test of trader skill. The dYdX Trading Arena will continue to host more exciting competitions, incorporating lessons from each event to improve the experience for all.