Wagyu Bull Run Cup S2 Results: Analyzing a $7M Trading Volume Battle with Prizes for Top Losers

Table of Contents

- Introduction

- Competition Overview

- A Unique Prize Structure: Rewarding More Than Just Profit

- Overall Performance Analysis

- Top Performer Analysis (ROI)

- Trading Volume and Style Insights

- Conclusion

Introduction

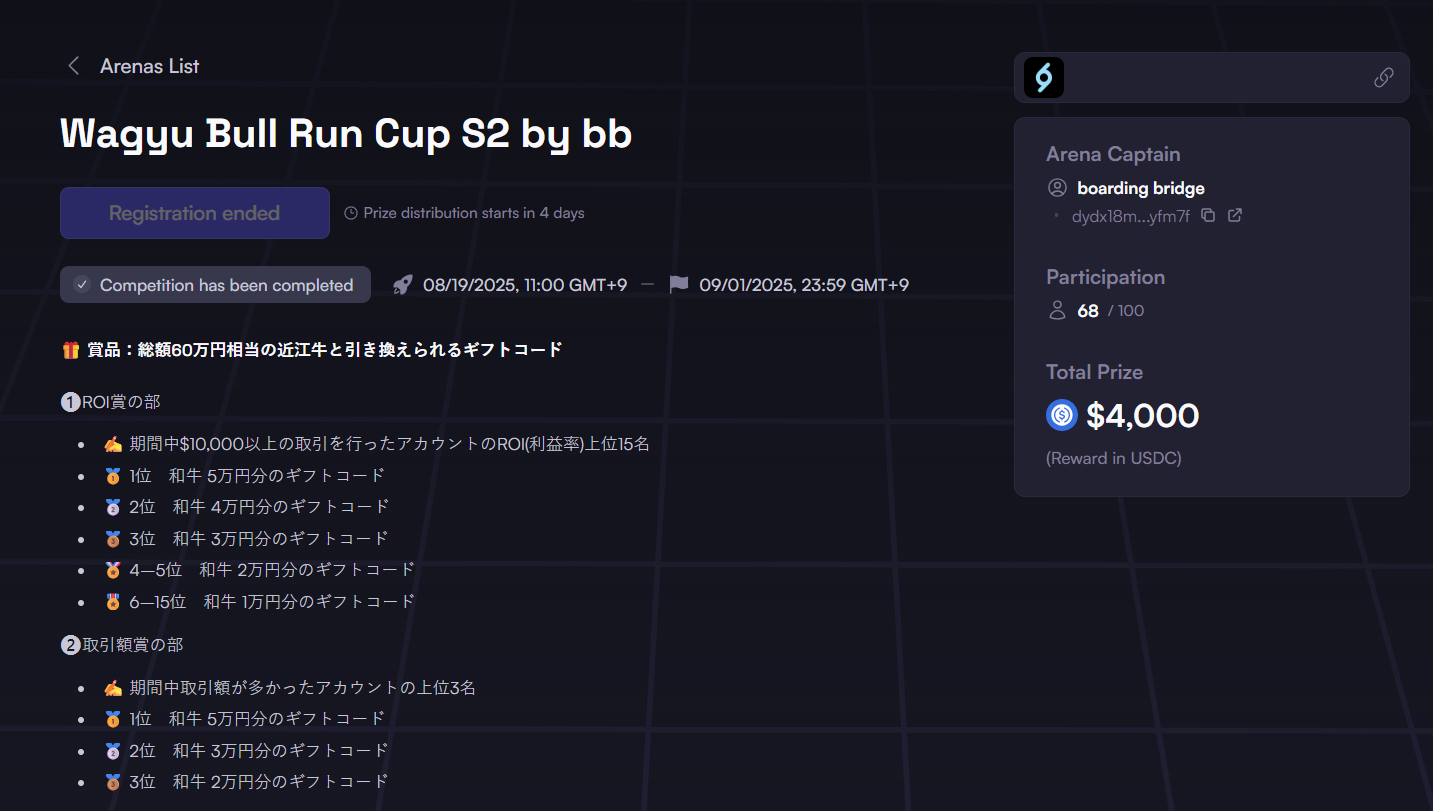

The dYdX Trading Arena continues to host some of the most engaging community-led trading events in the ecosystem. From August 19 to September 1, 2025, boarding bridge (bb), one of Japan's largest crypto communities, held the "Wagyu Bull Run Cup S2." This two-week competition attracted 68 traders and stood out not only for its impressive trading volume but also for its innovative and inclusive prize structure.

This article provides a comprehensive analysis of the competition, exploring overall performance, top trader strategies, and the unique approach to rewarding participants.

Competition Overview

The event saw a significant level of engagement, generating substantial trading activity and demonstrating the power of community-driven competitions.

- Duration: August 19 - September 1, 2025 (2 weeks)

- Platform: dYdX Trading Arena

- Participants: 68

- Total Trading Volume: Approx. 7,000,000 USDC

- Total Fees Paid: Approx. 2,649 USDC

With $7 million in volume, the competition successfully channeled significant liquidity and activity to the dYdX protocol, reinforcing the value of these community-hosted events.

A Unique Prize Structure: Rewarding More Than Just Profit

What set the Wagyu Bull Run Cup S2 apart was its multifaceted prize structure, which rewarded various aspects of trading beyond simple profitability. The total prize pool of approximately $4,000 was distributed as gift codes for premium Wagyu beef across several categories:

- ROI Prize: Rewarded the top 15 traders based on Return on Investment.

- Trading Volume Prize: Awarded to the top 3 highest-volume traders.

- Loss Amount Prize: A novel category that rewarded the top 5 traders who incurred the largest losses, honoring their courage and participation.

- Lucky Prize & Lucky 7 Prize: Randomly selected winners and those finishing in specific ranks (17th, 27th, 37th) to give everyone a chance to win.

This inclusive approach fostered a strong sense of community, acknowledging that in the zero-sum game of trading, even those who don't end in profit contribute significantly to the event's vibrancy.

Overall Performance Analysis

The competition data indicates that the two-week period presented a challenging market environment for most participants.

| Metric | Value |

|---|---|

| Overall Net PnL of Participants | -$6,876 |

| Total Profit from Winners | $4,172 |

| Total Loss from Losers | -$11,048 |

The negative net PnL, with total losses far exceeding total profits, highlights the difficult market conditions and the inherent risks of leveraged trading.

Top Performer Analysis (ROI)

Despite the tough market, several traders showcased exceptional skill and strategy to achieve outstanding returns. Here are the top 3 performers by ROI:

- デブゴク社長 (DebuGokuShacho)

- ROI: 135.69%

- PnL: +$294.43

- すいか (Suika)

- ROI: 95.08%

- PnL: +$191.88

- ンツンツ (Ntsuntsu)

- ROI: 93.11%

- PnL: +$188.45

Notably, trader leidream achieved the highest absolute profit among the top group with a PnL of +$1,335.15, demonstrating that a larger capital base can lead to more substantial dollar-value gains even with a slightly lower ROI (88.88%).

Trading Volume and Style Insights

The competition generated immense trading volume, revealing diverse strategies among the top participants.

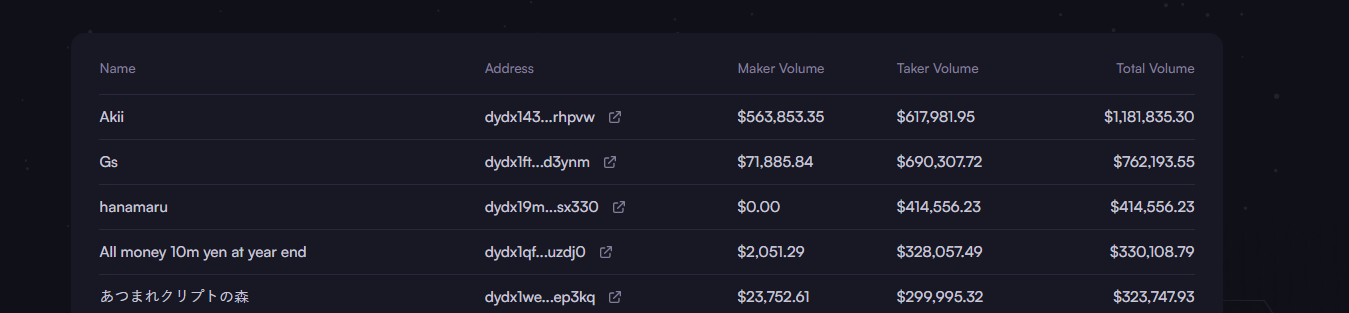

Top 5 by Trading Volume

- Akii: 1,181,840 USDC

- Gs: 762,194 USDC

- hanamaru: 414,556 USDC

- All money 10m yen at year end: 330,109 USDC

- あつまれクリプトの森: 323,748 USDC

The data revealed a fascinating diversity in trading styles:

- Balanced Strategy: The top volume trader, Akii, also secured a spot in the top 15 by ROI. Their trading was remarkably balanced, with Maker (limit) orders accounting for nearly 48% of their volume. This indicates a sophisticated strategy of both providing and taking liquidity.

- Aggressive Taker Strategy: In contrast, other high-volume traders like Gs and hanamaru relied almost exclusively on Taker (market) orders, favoring immediate execution.

This variety shows that there is no single path to success, with both patient, liquidity-providing strategies and aggressive, market-taking approaches being viable.

Conclusion

The "Wagyu Bull Run Cup S2 by bb" was another resounding success for the dYdX Trading Arena, proving its capability to host dynamic and engaging community events. The $7 million in trading volume highlights the significant liquidity these competitions bring to the dYdX ecosystem.

More importantly, the event's unique prize structure set a new standard for community inclusivity, celebrating not just the winners but all who dared to participate. It provided valuable lessons on strategy, risk management, and the power of a supportive community.

The dYdX Trading Arena will continue to partner with global community leaders to host more exciting competitions. To get involved in future events, visit the official website at https://dydxarena.com/.